Transactional analysis and trading advice for the European currency

The price test of 1.0422 occurred when the MACD was sufficiently distant from zero, which, in my opinion, limited the pair's downside potential. As a result, I did not sell the euro, although it is now obvious that a significant decline is imminent. Purchases of a reversal at 1.0374 resulted in losses. As the euro fell throughout the day, no additional entry points were formed.

The business activity index in France and Italy's services sector was quite acceptable, but this did not help the European currency, which resumed its decline against the US dollar. The US dollar strengthened even further in response to relatively positive reports regarding the growth of orders for durable goods and orders for industrial goods. Important data on retail sales in the eurozone and economic forecasts for the region are expected to be released this morning, which will likely harm the already-weak euro and result in a further decline in the pair. Therefore, I recommend that you act under scenario number 1. Markit's composite index of business activity and the PMI business activity index for the US services sector is released in the afternoon. The speech of FOMC member John Williams will not be as significant as the June FOMC meeting minutes. Traders will look for hints of a more aggressive policy, strengthening the dollar's position.

Buy Signal

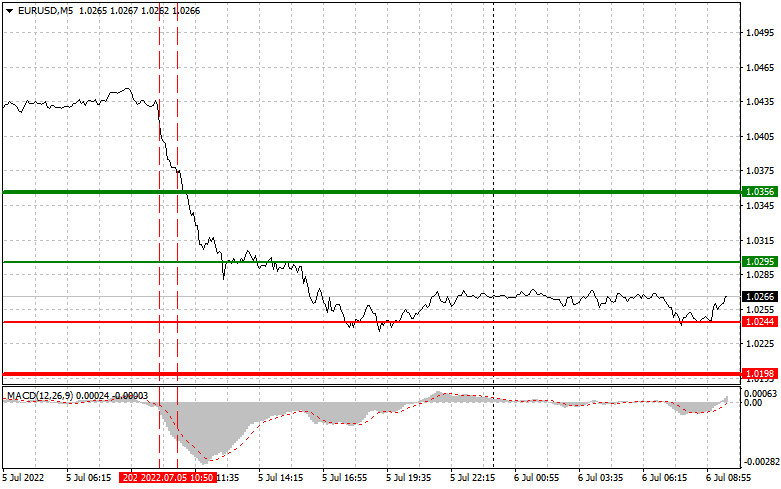

Scenario 1: Currently, you can purchase euros when the price reaches 1.0295 (the green line on the graph) to reach 1.0356. At 1.0356, I advise exiting the market and selling euros in the opposite direction, anticipating a 30-35-point movement in the opposite direction from the entry point. It is possible to anticipate a rise in the euro during the first half of today's trading session if eurozone macroeconomic indicators are positive and retail sales surge sharply, which is unlikely. Before purchasing, ensure that the MACD indicator is above zero and beginning to rise from there.

Scenario 2: It is possible to buy euros today if the price reaches 1.0244; however, the MACD indicator should be in the oversold region, limiting the pair's downward potential and causing a market reversal. We anticipate growth to diverge between 1.0295 and 1.0356.

Sell Signal

Scenario 1: You can sell euros once the price reaches 1.0244 (the red line on the chart). At the 1.0198 level, I recommend exiting the market and purchasing euros immediately in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). With weak economic reports and forecasts, the euro will experience renewed pressure. Before you sell, ensure that the MACD indicator is below zero and just beginning to decline from there.

Scenario 2: It is possible to sell the euro today if the price reaches 1.0295, but the MACD indicator should be in the overbought region, limiting the pair's upward potential and leading to a market reversal of the downside. We anticipate a fall to the inverse levels of 1.0244 and 1.0198.

What's on the chart:

The thin green line represents the price at which a trading instrument can be purchased.

The thick green line represents the estimated price at which you can place a bid. Take profit or fix profits yourself, as further growth above this level is unlikely;

The thin red line represents the minimum selling price for a trading instrument.

The thick red line represents the estimated price at which you can place a bid. Take profit or fix profits yourself, as further decline below this level is unlikely;

MACD is an indicator. When entering the market, it is essential to use overbought and oversold zones as a guide.

Important. When entering the Forex market, novice traders must make very prudent decisions. Before releasing significant fundamental reports, it is prudent to avoid the market to avoid sharp fluctuations in the exchange rate. You should always use stop orders to limit your losses if you choose to trade during the news release. Without stop orders, you can lose your entire deposit quickly, particularly if you do not use money management and trade in large volumes.

Remember that a clear trading plan, similar to the one I provided in the preceding example, is necessary for successful trading. Intraday traders who make trading decisions haphazardly based on the current market situation have a losing strategy.