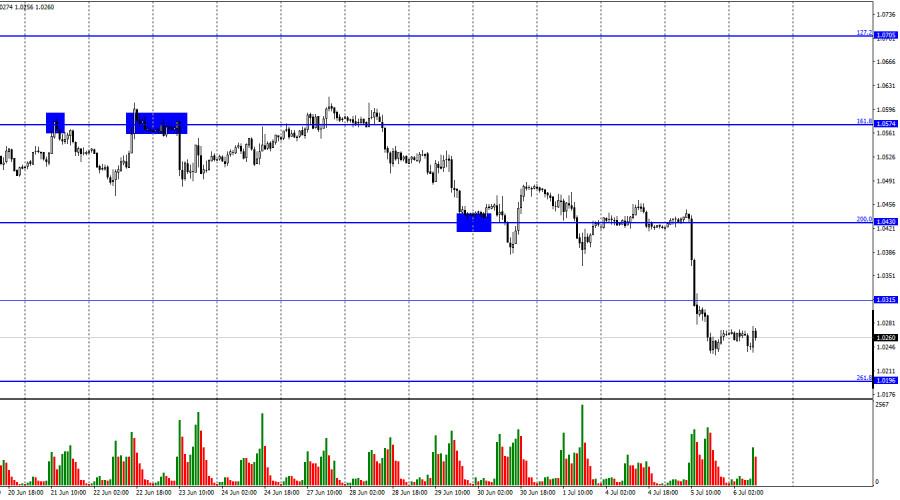

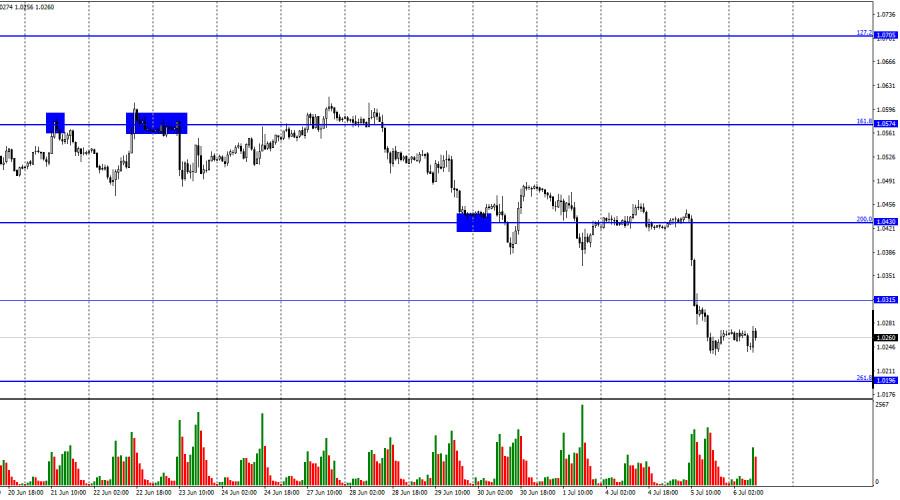

The EUR/USD pair is reversing yesterday's decline on Wednesday. Yesterday, the pair's quotes secured below the 1.0315 level and had every chance of falling to the Fibonacci level of 261.8 percent, which is 1.0196. However, this did not occur, and traders are contemplating their next move. There is no need to discuss a correction because the pair's upward trend has not yet begun. This morning, the European Union released the industry business activity index, which was significantly weaker than anticipated and totaled only 47 points. The euro resisted the temptation to begin another decline, but, as they say, the worst is yet to come. The Federal Reserve will release the so-called "minutes" of the previous meeting tonight. This report typically contains only general information, which is of little interest to traders. However, this time may be different, as the probability of a 0.75 percent rate hike in July increases daily. Currently, it's between 80 and 90 percent, which is a lot considering that the American regulator raised the rate by 0.75 percent last month.

But what else can be done if inflation in the United States continues to rise inexorably and monetary policy tightening is ignored? Thus, in the evening, traders will examine the "minutes" for hints regarding the magnitude of this month's policy tightening. I think it would be best to wait for the next inflation report, as this indicator will determine how quickly the Fed raises interest rates. If inflation begins to moderate, FOMC members may be reassured, and 0.5 percentage points may increase the rate. If the slowdown is minimal or nonexistent, there is no doubt that the Fed will raise interest rates by the maximum amount. And in this case, the US dollar may continue its growth, which is displayed as a decline on the euro-dollar pair. Already, the pair has been trading at its lowest level in the past two decades.

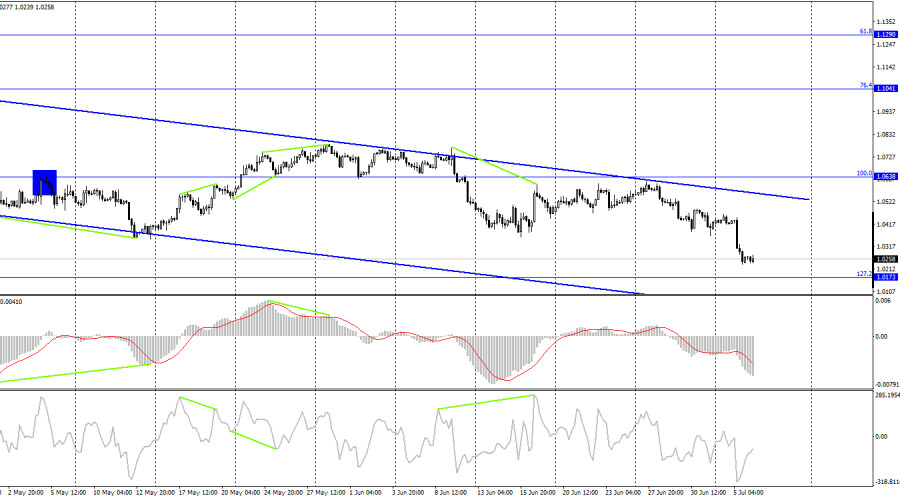

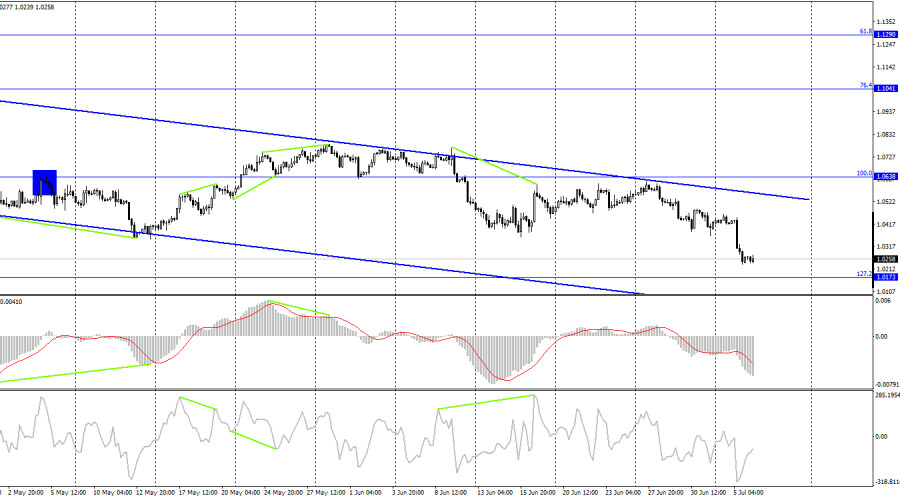

On the 4-hour chart, the pair continues to fall toward the corrective level of 127.2% (1.0173). The pair's rebound from this level will benefit the euro and lead to some growth in the direction of the lower line of the descending corridor, which continues to characterize traders' current "bearish" sentiment. I do not anticipate a rapid increase in the value of the EU's currency until it is fixed above the corridor. Emerging divergences are not currently observable in any indicator.

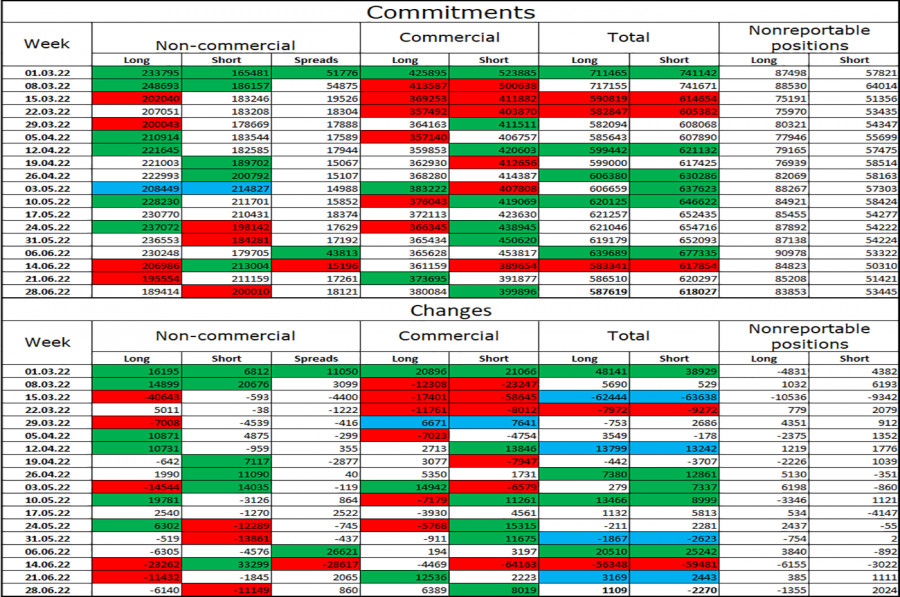

Report on Commitments of Traders (COT):

Speculators closed 6,140 long contracts and 11,149 short contracts during the previous reporting week. This indicates that the "bearish" sentiment of the major market participants has weakened slightly but remains "bearish." The total number of long contracts held by speculators is 189 thousand, and the number of short contracts is 200 thousand. The disparity between these numbers is negligible, but it does not favor the bulls. Most "Non-commercial" traders have maintained a "bullish" outlook on the euro in recent months, which has not helped the euro currency. Recent COT reports indicate that new sales of the EU currency may follow, as speculators' sentiment has shifted from "bullish" to "bearish" over the past few weeks. The Fed and the ECB have not provided positive updates regarding the euro.

News calendar for the United States and Europe:

EU - index of construction sector business activity (07:30 UTC).

EU - retail sales volume (09:00 UTC).

US - ISM Purchasing Managers' Index for the USA's non-manufacturing sector (14:00 UTC).

US - publication of FOMC protocols (18:00 UTC).

The economic event calendars of the European Union and the United States contain minor entries on July 6, but there may be a reaction to the FOMC protocol or the ISM index. Therefore, the information context's effect on traders' sentiment may be of average strength.

EUR/USD forecast and trader recommendations:

I suggested selling the pair on the hourly chart when it anchored below 1.0430 with a target of 1.0315. This level has been adjusted. New sales are suggested at 1.0315 with a target of 1.0196. On a 4-hour chart, I advise buying the euro when the price is above the corridor with a target of 1.1041.