Despite a completely empty macroeconomic calendar, the currency market's direction of movement turned around sharply, and the dollar began to actively rise in price. The reason for this was the rumors about US President Joseph Biden's address to the United States Congress, which should take place today. Biden is expected to ask the House of Representatives for a fuel tax holiday. In particular, for gasoline, the cost of which has jumped to record levels, which is perhaps the most sensitive issue for American society. However, the reaction of the market is more of an emotional nature, and is only a reaction to the very desire of the state to fight inflation. Yes, and tax cuts by business are always perceived as an exceptionally positive factor. However, investors are likely to end up disappointed as Congress can only decide on the 18.4 cents per gallon federal tax on gasoline. Gasoline prices have long since topped $5 a gallon, so the potential cost reduction won't be all that noticeable. Moreover, each state has its own additional taxes on gasoline, the size of which varies from 14.66 cents in Alaska to 66.98 cents in California. And this is without taking into account possible additional fees that may be introduced not only by the states themselves, but also by their individual districts. The federal government cannot force the states to impose or eliminate any tax. It can only call them to such steps.In any case, the market has already won back the introduction of tax holidays. Now everything depends not only on Congress, but also on the states. Will they follow the example of the federal authorities? It is clear that the reaction, even if it happens, will not follow immediately. But as soon as investors see that we are talking only about a slight reduction in the tax component in the price of fuel, then a rollback will follow in the foreign exchange market, with the prospect of returning to yesterday's highs.

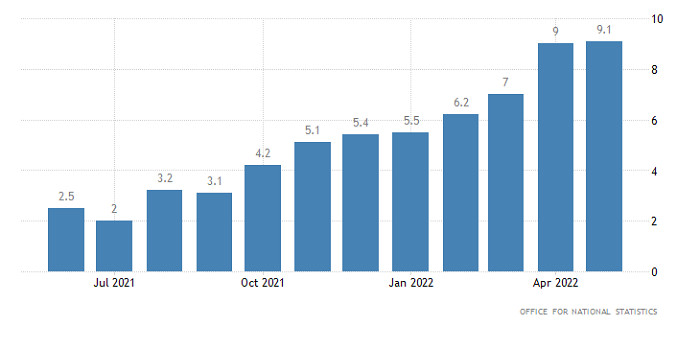

At the same time, as we can see, the issue of the cost of fuel in the United States is the most important. Since the market has actually ignored the data on inflation in the UK. But the growth rate of consumer prices accelerated from 9.0% to 9.1%. Which, in principle, removes all questions regarding the further actions of the Bank of England. During the next meeting of the board, the refinancing rate will be raised by 0.50%. And in theory, this should contribute to the pound's growth. But that doesn't happen.

Inflation (UK):

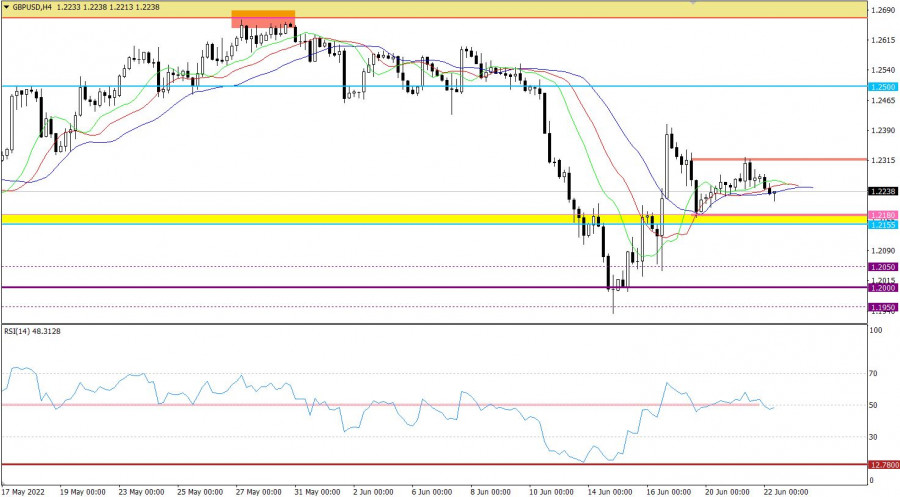

The GBPUSD currency pair rushed down following the euro, partially winning back the recent price rebound from the support area of 1.2155/1.2180. In fact, we have a variable turbulence, which can lead to forming a short-term flat.

The technical instrument RSI H4 is moving within the deviation of the 50 line, which indicates a stagnation. RSI D1 is in the lower area of the 30/50 indicator, which signals a downward trend.

The Alligator H4 indicator has a lot of crossovers between the MA lines, which indicates stagnation. Alligator D1 is in a downtrend cycle, MA moving lines are pointing down.

Expectations and prospects

The values of 1.2180/1.2320 are considered as variable boundaries of a possible flat. Price fluctuations within the range will lead to abundant attention among speculators, which will eventually provoke new price spikes. In this situation, work within the established limits is allowed among traders, but the breakout method is considered the main tactic. Thus, keeping the price outside one or another border can indicate the next path in the market.

Complex indicator analysis has a variable signal in the short-term and intraday periods. Indicators in the medium term are focused on the main downward trend.